Overview:

According to FTM Consulting Inc., the structured cabling systems (SCS) market is forecast to grow at a compound average annual growth rate of 13.1% through 2015. Frank Murawski, President of FTM Consulting Inc. stated that, “This latest study of the SCS market includes an analysis and forecast of SCS spending by 17 different vertical markets, such as healthcare, retail, manufacturing, finance/insurance services, etc. The analysis combined federal government data statistics for the individual industries (number of employees, number of firms, etc.) with FTM Consulting’s vast database on the SCS market.”

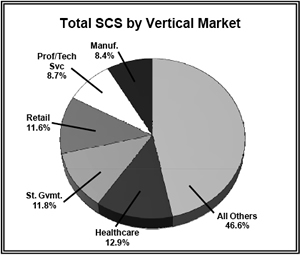

One of the more interesting findings from this study is that healthcare was the leading vertical market customer for SCS products in 2010. Healthcare spending of $680.7 million accounted for 12.9% of the total 2010 SCS Market. The Pie chart shows the market shares for the total SCS Market in 2010 by the five leading vertical market sectors. After healthcare, state government is the second largest sector, with an 11.8% share, followed by the retail sector, with an 11.6% share. The other two leading sectors include professional and technical services at an 8.7% share and manufacturing with an 8.4% share. These five vertical sectors account for more than half the SCS market in 2010. The study includes the same market share data for 2015. The study also includes vertical share data for UTP cabling and fiber cabling. As a result, unique data, such as the leading vertical sector for fiber cable usage in 2010 and 2015, is provided in this study.

Questions answered by this report:

- What is the largest vertical market for UTP copper cables? — fiber cables?

- How large is the SCS market for Healthcare, Retail or Manufacturing?

- What will be the largest vertical market for fiber cables in 2015?

- Which are the primary vertical markets to target in the future?

- For the healthcare sector, how large is the SCS market for LANs — Data Centers — VOIP?

- What will be the impact of emerging technologies (100 Gbps now, 1000 Gbps in the future) on the future SCS market?

Table of Contents

Chapter 1

Introduction

Study Objectives

Vertical Markets

Methodology/Sources

General Notes

Chapter 2

Executive Summary

Total SCS Market Forecast

Copper Cabling Market Forecast

Fiber Cabling Systems Forecast

Total SCS Market Forecast by Vertical Markets

Health Care: Primary Vertical Market of

Opportunity

Chapter 3

Vertical Market Definitions

Federal Government Industry Classification

Systems Background

NAICS

Manufacturing Sector

Utilities Sector

Wholesale Sector

Retail Sector

Transportation & Warehousing Sector

Information Sector

Financial/Insurance Sector

Real Estate Sector

Professional/Scientific/Technical Services

Educational Sector

Health Care Sector

Construction Sector

Administrative& Support Services

Hotel & Food Service Sector

State Government Sector

Federal Government Sector

Other Sector

Chapter 4

Technology/Product Trends/

Developments

Health Care Cabling Developments

100 Gbps Ethernet

Power Over Ethernet (PoE) Plus

OM 4 Fiber Cables

Chapter 5

Total SCS Market Forecasts

Total SCS Forecast

Total SCS Forecast by Copper & Fiber

Segments

Total SCS Forecast by Major Product

Segments

Total SCS Forecast by Major Applications

Chapter 6

Copper Cabling Forecasts

Total Copper Cabling Forecast

Copper Cabling Forecast by Major Product

Segments

Copper Cabling Forecast by Applications

Chapter 7

Fiber Cabling Systems Forecast

Total Fiber Cabling Systems Forecast

Fiber Cabling Systems Forecast by Major

Product Segments

Fiber Cabling Systems Forecast by Applications

Chapter 8

Copper Cable Forecast

Total Copper Cable Forecast

Copper Cable UTP-Coax Segment Forecast

Copper Cable Volume Forecast – UTP –Coax

Segments

Copper Cable Forecast by Applications

Chapter 9

Fiber Cable Forecast

Total Fiber Cable Forecast

MM-SM Fiber Cable Forecast

Total Fiber Cable Volume Forecast

MM-SM Fiber Cable Volume Forecast

Fiber Cable Forecast by Applications

Fiber Cable Volume Forecast by Applications

Chapter 10

Total SCS Vertical Markets Forecast

Total SCS by Vertical Market Forecast

LAN Market by Vertical Markets Forecast

Data Center by Vertical Markets Forecast

VOIP by Vertical Markets Forecast

Health Care by Cabling Application Forecast

State Government by Cabling Application Forecast

Retail by Cabling Application Forecast

Professional/Technical Services by Cabling Application Forecast

Manufacturing by Cabling Application Forecast

Chapter 11

UTP Cabling Vertical Market Forecast

Total UTP Cabling by Vertical Markets Forecast

LAN UTP Cabling Market by Vertical Markets Forecast

Data Center UTP Cabling by Vertical Markets

Forecast VOIP UTP Cabling by Vertical Markets Forecast

Health Care by Cabling Application UTP Cabling Forecast

State Government UTP Cabling Forecast by Cabling Applications

Retail UTP Cabling by Cabling Applications

Professional/Technical services UTP Cabling by

Cabling Application Forecast

Manufacturing UTP Cabling Forecast by Cabling Applications

Chapter 12

Fiber Cabling Vertical Market Forecast

Total Fiber Cabling Vertical Market Forecast

LAN Fiber Cabling by Vertical Markets Forecast

Data Center Fiber Cabling by Vertical Markets Forecast

VOIP Fiber Cabling by Vertical Markets Forecast

Health Care Fiber Cabling by Application Forecast

State Government Fiber Cabling by Cabling Applications

Retail Fiber Cabling by Applications Forecast

Professional/Technical Services by Application Forecast

Other Sector by Application Forecast

Chapter 13

UTP Cable Vertical Market Forecast

Total UTP Cable Market by Vertical Markets Forecast

UTP Cable Volume Forecast by Vertical Markets Forecast

LAN UTP Cable Forecast by Vertical Markets

Data Center UTP Cable Market by Vertical Markets Forecast

VOIP UTP Cable Market by Vertical Markets Forecast

Health Care UTP Cable Forecast by Applications

State Government UTP Cable Forecast by Applications

Retail UTP Cable Forecast by Applications

Manufacturing UTP Cable Forecast by Applications

Professional/Technical Services UTP Cable Forecast by Applications

Chapter 14

Fiber Cable Vertical Market Forecast

Total Fiber Cable Forecast by Vertical Markets

LAN Fiber Cable by Vertical Market Forecast

Data Center Fiber Cable Forecast by Vertical Markets

VOIP Fiber Cable Forecast by Vertical Markets

Healthcare Fiber Cable Forecast by Cabling Applications

State Government Fiber Cable Forecast by Cabling Applications

Retail Fiber Cable Forecast by Cabling

Applications Manufacturing Fiber Cable forecast by Cabling Applications

Professional/Technical Services Fiber Cable by Cabling Applications

Table of Figures

Chapter 2

Fig. 2.1 Total SCS Market Forecast

Fig. 2.2 Total Copper Cabling Forecast

Fig. 2.3 Total Fiber Cabling Forecast

Fig. 2.4 Total SCS by Vertical Market Trends

Chapter 3

Fig. 3.1 NAICS Industry Structure

Fig. 3.2 NAICS - Vertical Markets

Chapter 5

Fig. 5.1 Total SCS Market Forecast

Fig. 5.2 Total SCS Market by Copper & Fiber Segments Forecast

Fig. 5.3 Fiber versus Copper SCS Market Trends

Fig. 5.4 Total SCS market by Cable & Apparatus Forecast

Fig. 5.5 Total SCS Market by Cabling Applications

Fig. 5.6 Total SCS Market by Application Trends

Chapter 6

Fig. 6.1 Total Copper Cabling Forecast

Fig. 6.2 Total Copper Cabling Forecast by Major Product Segments

Fig. 6.3 Copper Cabling by Major Applications Forecast

Fig. 6.4 Copper Cabling by Application Trends

Chapter 7

Fig. 7.1 Total Fiber Cabling Forecast

Fig. 7.2 Fiber Cabling Forecast by Major Product Segments

Fig. 7.3 Fiber Cabling Forecast by Applications

Fig. 7.4 Fiber Cabling by Application Trends

Chapter 8

Fig. 8.1 Total Copper Cable Forecast

Fig. 8.2 UTP-Coax Cable Forecast

Fig. 8.3 Total Copper Cable Volume Forecast

Fig. 8.4 UTP-Coax Cable Volume Forecast

Fig. 8.5 UTP Copper Cable Forecast by Applications

Fig. 8.6 UTP Copper Cabling by Application Trends

Fig. 8.7 UTP Copper Cable Volume Forecast by Applications

Fig. 8.8 Copper UTP Cable Volume by Application Trends

Chapter 9

Fig. 9.1 Total Fiber Cable Forecast

Fig. 9.2 Fiber Cable MM-SM Forecast

Fig. 9.3 Total Fiber Cable Volume Forecast

Fig. 9.4 Fiber Cable MM-SM Volume Forecast

Fig. 9.5 Fiber Cable Forecast by Applications

Fig. 9.6 Fiber Cable by Applications Trends

Fig. 9.7 Fiber Cable volume Forecast by Applications

Fig. 9.8 Fiber Cable Volume by Application Trends

Chapter 10

Fig. 10.1 Total SCS Market by Vertical Market

Fig. 10.2 Total SCS by Vertical Market Trends

Fig. 10.3 LAN Market by Vertical Market

Fig. 10.4 Data Center Market by Vertical Market

Fig. 10.5 VOIP Market by Vertical Market

Fig. 10.6 Health Care by Cabling Applications Forecast

Fig. 10.7 Health Care by Application Trends

Fig. 10.8 State Government by Cabling Application Forecast

Fig. 10.9 State Government by Cabling Application Trends

Fig. 10.10 Retail by Cabling Applications

Fig. 10.11 Retail by Cabling Application Trends

Fig. 10.12 Professional/Technical Services by Cabling Application Forecast

Fig. 10.13 Professional/Technical Services by Cabling Application Trends

Fig. 10.14 Manufacturing by Cabling Application Forecast

Fig. 10.15 Manufacturing by Cabling Application Trends

Chapter 11

Fig. 11.1 UTP Cabling Market by Vertical Market

Fig. 11.2 UTP Cabling by Vertical Market Trends

Fig. 11.3 LAN UTP Cabling Market by Vertical Market

Fig. 11.4 Data Center UTP Cabling Market by Vertical Market

Fig. 11.5 VOIP UTP Cabling Market by Vertical Market

Fig. 11.6 Health Care UTP Cabling by Cabling Application Forecast

Fig. 11.7 Health Care by UTP Cabling Application Trends

Fig. 11.8 State Government UTP Cabling by Cabling Application Forecast

Fig. 11.9 State Government by Cabling Application Trends

Fig. 11.10 Retail UTP Cabling by Cabling application Forecast

Fig. 11.11 Retail by Cabling Application Trends

Fig. 11.12 Professional/Technical Services UTP Cabling by Cabling Applications Forecast

Fig. 11.13 Professional/Technical Services UTP Cabling by Application Trends

Fig. 11.14 Manufacturing UTP Cabling by Cabling Applications Forecast

Fig. 11.15 Manufacturing by Cabling Application Trends

Chapter 12

Fig. 12.1 Fiber Cabling by Vertical Market

Fig. 12.2 Fiber Cable by Vertical Market Trends

Fig. 12.3 LAN Fiber Cable by Vertical Markets

Fig. 12.4 Data Center Cabling Market by Vertical Markets

Fig. 12.5 VOIP Fiber Cabling Market by Vertical Markets

Fig. 12.6 Health Care Fiber Cabling by Cabling Application Forecast

Fig. 12.7 Health Care by Cabling Application Trends

Fig. 12.8 State Government Fiber Cabling by Cabling Application Forecast

Fig. 12.9 State Government by Cabling Application Trends

Fig. 12.10 Retail Fiber Cabling by Cabling Application Forecast

Fig. 12.11 Retail by Cabling Application Trends

Fig. 12.12 Professional/Technical Services Fiber Cabling by Cabling Application Forecast

Fig. 12.13 Professional/Technical Services Fiber Cabling by Application Forecast

Fig. 12.14 Other Fiber Cabling by Cabling Application Forecast

Fig. 12.15 Other by Cabling Application Trends

Chapter 13

Fig. 13.1 UTP Cable Market by Vertical Markets

Fig. 13.2 UTP Cable Market by Vertical Market Trends

Fig. 13.3 UTP Cable Volume Market by Vertical Markets

Fig. 13.4 UTP Cable Volume by Vertical Market Trends

Fig. 13.5 LAN UTP Cable Market by Vertical Markets

Fig. 13.6 Data Center UTP Cable Market by Vertical Markets

Fig. 13.7 VOIP UTP Cable Market by Vertical Markets

Fig. 13.8 Health Care UTP Cable by Cabling Applications Forecast

Fig. 13.9 Health Care UTP Cable by Cabling Application Trends

Fig. 13.10 State Government UTP Cable by Cabling Applications Forecast

Fig. 13.11 State Government UTP Cable by Application Trends

Fig. 13.12 Retail UTP Cable by Cabling Applications Forecast

Fig. 13.13 Retail UTP Cable by Application Trends

Fig. 13.14 Manufacturing UTP Cable by Cabling Applications Forecast

Fig. 13.15 Manufacturing UTP Cable by Application Trends

Fig. 13.16 Professional/Technical Services UTP Cabling Applications Forecast

Fig. 13.17 Professional/Technical Services UTP Cable by Application Trends

Chapter 14

Fig. 14.1 Fiber Cable Market by vertical Markets

Fig. 14.2 Fiber Cable by Vertical Market Trends

Fig. 14.3 Fiber Cable Volume Market by vertical Markets

Fig. 14.4 Fiber Cable volume by Vertical Market Trends

Fig. 14.5 LAN Fiber Cable Market by Vertical Markets

Fig. 14.6 Data Center Fiber Cable Market by Vertical Markets

Fig. 14.7 VOIP Fiber Cable Market by Vertical Markets

Fig. 14.8 Health Care Fiber Cable by Cabling Applications Forecast

Fig. 14.9 Health Care Fiber Cable by Application Trends

Fig. 14.10 State Government Fiber Cable by Cabling Application Trends

Fig. 14.11 State Government Fiber Cable by Application Trends

Fig. 14.12 Retail Fiber Cable by Cabling Application trends

Fig. 14.13 Retail fiber Cable by Application trends

Fig. 14.14 Manufacturing fiber cable by Cabling Application Forecast

Fig. 14.15 Manufacturing Fiber Cable by application trends

Fig. 14.16 Professional/technical services Fiber Cable by Cabling Application Forecast

Fig. 14.17 Professional/technical services Fiber Cable by Application Trends

TOP

|